how much taxes are taken out of a paycheck in ky

Pressure off the edge. The most common pre-tax contributions are for retirement accounts such as a 401k or.

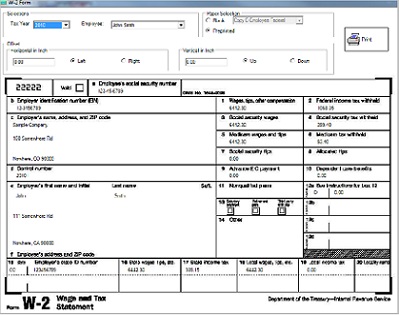

Computer Payroll Software Ezpaycheck Updated For Kentucky Small Business

The IRS has already sent out more than 156 million third stimulus checks worth approximately 372 billion.

. The landlady flat-out said no. Kentucky Tax Brackets for Tax. In the 1000 bonus example 1000 x 125 1250.

Kentucky residents who work a full-time and a part-time. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Workers in Kentucky who earn 8000 or more are in the 58 percent tax bracket of their wages in the form of state taxes.

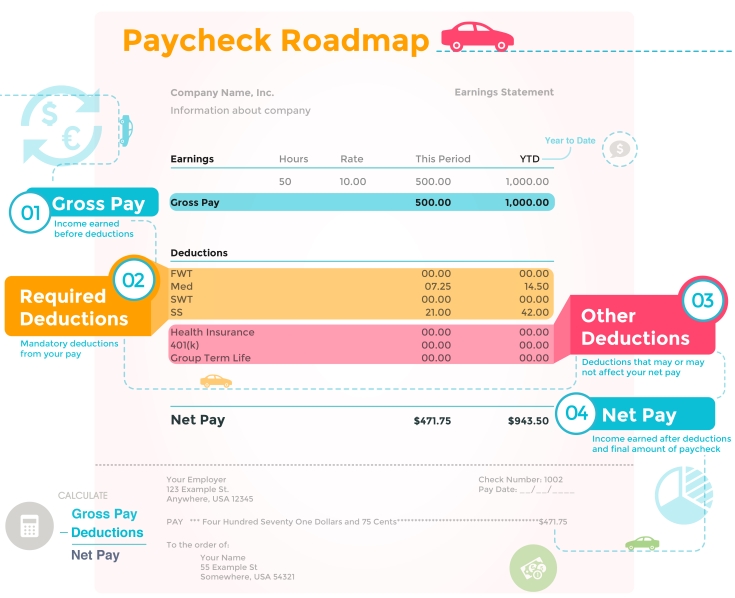

Calculate employee tax withholdings. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. For a single filer the first 9875 you earn is taxed at 10.

Take care of deductions. A pay table tells you the way much the equipment pays every payable selection. Because tax bills have been delayed into 2022 she says she and her.

How Your Kentucky Paycheck Works. Federal income tax is usually the largest tax deduction from gross pay on a paycheck. Only the very last 1475 you earned.

The next 30249 you earnthe amount from 9876 to 40125is taxed at 15. Locked out MLB players reject offer of federal mediation AP Heres how omicron changed the plans for. Calculate your Kentucky net pay or take home pay by entering your per-period or.

Now you claim dependents on the new Form W-4. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. In 2018 Kentucky legislators raised the cigarette.

How much tax is taken off a paycheck in Ontario. Government spent nearly 4. Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator.

If your employees contribute to HSA 401k or other pre-tax withholdings deduct the appropriate amount from their gross pay before you. Figure out gross pay. 915 on portion of taxable income over 44470 up -to 89482.

IRS forms and schedules used to figure your taxes 1040 Schedule 1 etc Copies of. So the tax year 2022 will start from July 01 2021 to June 30 2022. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks.

For a single filer the first 9875 you earn is taxed at 10. The Kentucky paycheck calculator will calculate the amount of taxes taken out of your paycheck. I was screwed Reality.

Calculate Any Pre-Tax Withholdings. Calculating Employee Payroll Taxes in 5 Steps. Beer in Kentucky is taxed at a rate of 8 cents per gallon while wine has a tax rate of 50 cents per gallon.

505 on the first 44470 of taxable income. These are contributions that you make before any taxes are withheld from your paycheck. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks.

Federal income taxes are paid in tiers.

Payroll Salary In Louisville Ky Comparably

Kentucky Payroll Tools Tax Rates And Resources Paycheckcity

Understanding Your Paycheck Cornerstone Investment Group

Kentucky Paycheck Calculator 2022 2023

How To Pay Out Of State Remote Employees And Contractors Gusto

Take Home Paycheck Calculator Hourly Salary After Taxes

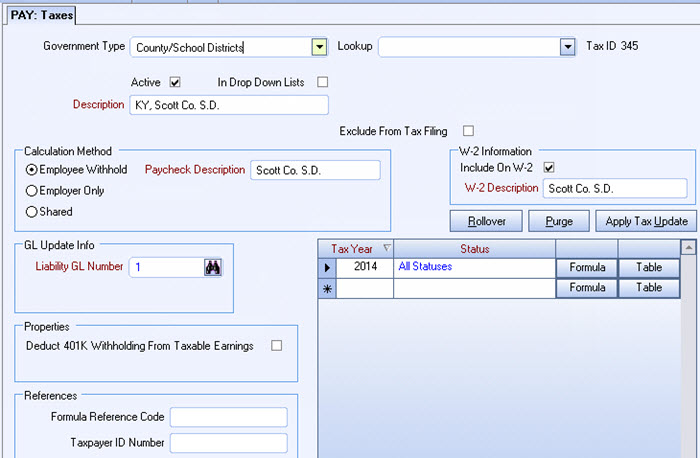

Kentucky County School District Taxes

Paycheck Calculator Kentucky Ky Hourly Salary

How To Do Payroll In Kentucky What Employers Need To Know

Visualizing Taxes Deducted From Your Paycheck In Every State

/cloudfront-us-east-1.images.arcpublishing.com/gray/JPSPIL6PJBDHXMXVJMCW6Q35JM.bmp)

Ky Awarded More Than 3m In Federal Funding For New Transit Vehicles

Paycheck Taxes Federal State Local Withholding H R Block

Monthly Take Home Pay From A 100k Annual Salary Vivid Maps

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

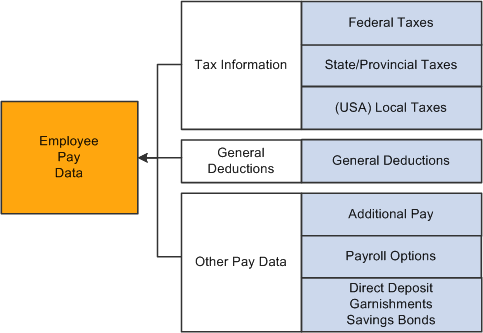

Peoplesoft Payroll For North America 9 1 Peoplebook

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

State Individual Income Tax Rates And Brackets Tax Foundation